Weekly Outlook

Weekly Market Overview: Not Yet Over

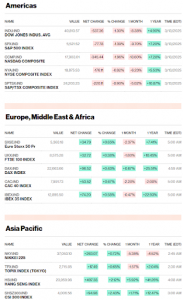

What a week ! US equities’ indexes remained down by more than -3.5% in a week, on the way to the fourth consecutive weeks of loss, the worst weekly streak of losses in three years. What happened in the last week was a mix of bearish investors’ sentiments, weaker US job numbers, and President Trump’s ongoing trade war. Trump threatened 200% tariffs on EU wines & spirits in retaliation to EU’s proposed duties on American whisky. As of today, SPX lost -3.5% on weekly basis, followed by -4% in Dow Jones, -4% in Nasdaq, not to forget German DAX -1.7%, & FTSE100 is still down by -1.2%.

Stock Market Overview : Bloomberg

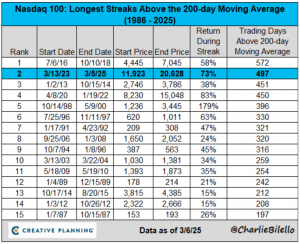

In the meantime, Nasdaq ended the 2nd longest uptrend in the history of this index, closing below 200-Day Moving Average in nearly two years.

Numbers: Charlie Bilello

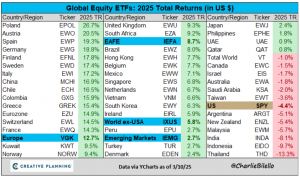

Since the beginning of 2025, US stocks underperformed the major EZ equity indexes, Switzerland , UK and UAE. Last month, US job market created 151K in nonfarm payrolls, weaker than the estimates, labor participation rate declined & unemployment increased to 4.1% from 4%. Trump warned of possible recession in 2025, adding serious concerns about the health of the US economy in 2025. Remember that the investors expected an exceptional year for America in 2025, is it going to fail? The so called” US exceptionalism” created overvalued equities, and now it is time for correction.

Numbers: Charlie Bilello

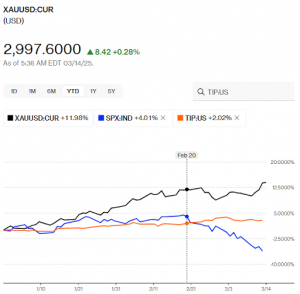

Gold gained 40% YoY, 15% in 2025, adding another 3% in a week, and approaching new -record high at $3000 per ounce. It is not only the chaos of global trade due to Trump’s tariffs, but also true that the markets were always faster than the economic reality which means that the higher inflation globally was already priced in. US treasury inflation protected securities or TIPS increased 3% in 2025, positively correlated to the performance of gold , and reverse correlation with SPX that fell by -6% YTD. Weaker US growth ahead, more dovish stance by the major central banks, global trade’s chaos , and consequences of Trump’s tariffs on the cost of imports are likely to result in higher inflation which is the best scenario for gold.

Chart : Bloomberg